In the realm of politics, where privilege, power, and responsibility come hand in hand, the ethical implications of congressional insider trading cast a troubling shadow over the core democratic values upon which our country was founded. The lawmakers and members of Congress, who we entrust to create laws for the benefit of our society, have often abused private information for personal gain in the past and it doesn’t seem like it will change anytime soon. Insider trading is the buying or selling of stock using non-public information, which was banned in 1934 through the Securities and Exchange act. Yet, in 2022 alone, there were 78 cases of members of congress violating insider trading regulations. The existence of double standards in insider trading among government officials is not only unjust but also deeply unethical, demanding immediate attention and rectification.

In 2012, the Stop Trading on Congressional Knowledge (STOCK) Act was introduced to promote greater transparency by requiring timely reports of financial trades from all members of Congress. This legislation aimed to prohibit the use of non-public information for personal trading. However, it regrettably did little to enhance or establish effective enforcement measures. Although the STOCK Act was a step in the right direction, its requirement of a 30-day disclosure period fell short in preventing government officials from continuing to engage in illegal insider trading.

In a notable example from 2020, Representative Mike Kelly of Pennsylvania obtained non-public information about a steel plant that contradicted the publicly available information suggesting its closure. Just prior to the public announcement that the plant would remain open, Mr. Kelly and his wife purchased between $15,001 to $50,000 worth of stock valued at approximately $4.70 per share. Months later, they sold their investment at around $18.11 per share, effectively capitalizing on their private information while evading the disclosure requirements imposed by the 30-day rule. This incident highlights the inadequacy of the STOCK Act in preventing such abuses.

Furthermore, the STOCK Act fails to impose penalties on members of Congress for engaging in insider trading. Despite numerous credible claims of insider trading involving members of Congress, not one member has faced prosecution under the STOCK Act. Moreover, the minimal penalties of $200 imposed on a member of Congress failing to report a financial transaction does not serve as a strong enough deterrent when taking into account the thousands they earn off of insider trading.The lack of rigorous enforcement perpetuates a pattern where members of Congress are suspected of engaging in insider trading without facing legal consequences for their actions.

As members of Congress continue to engage in insider trading, the effectiveness of regulations to ensure fair markets has failed. The Securities and Exchange Commission (SEC), entrusted with the task of punishing illegal insider traders, cannot maintain credibility while turning a blind eye to the same misconduct committed by government officials. The absence of penalties for insider trading by members of Congress conveys a troubling message that those in power are exempt from the rules that govern the rest of us. As representatives of the people, government officials are held to the highest standards of transparency and integrity. The public warrants the right to understand the motivations behind the actions of lawmakers who shape our society. It also begs the question for regular traders, should traders continue to participate and fund an inherently unfair framework that benefits the already wealthy?

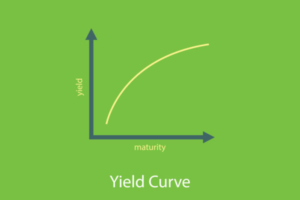

Insider trading not only erodes public trust in government officials but also deprives regular investors of fair financial opportunities. By distorting the market based on non-public information, insider trading prevents prices from responding normally to information available to the public. Regular investors, who spend hours in researching the true value of underlying companies, can suffer significant financial losses when stock prices fluctuate unexpectedly, disregarding the company’s actual worth.

A citizen of the United States is entitled to the same rights as any other citizen, regardless of political influence, when it comes to accessing and participating in the stock market. Government officials, who already enjoy privileges and financial advantages, should not break legal bounds to benefit from practices that harm ordinary people. The unethical practice of insider trading by members of Congress is slowly being addressed and eradicated. By continuing to demand change and establish independent oversight, traders can protect the integrity of our democracy, restore public trust, and ensure equitable opportunities for all in the financial markets.